suara gw (my voices) @ maen saham

new post for THE FED problems

imbal hasil INVESTASI REKSA DANA gw SEJAK 2002, 2003, 2005, n 2007 SUKSES menundukkan BUNGA MAJEMUK DEPOSITO BANK

yang TERBUKTI BENER: the fed menunda KEPUTUSAN KENAEKAN BUNGA the fed fund

ada kemiripan TREN: Dow Jones Industrial Average Index dg IHSG ... saat FED SCARE (kecemasan the Fed MENAEKKAN bunga / the FED FUND RATE), maka ke2 indeks TURUN ...

hukum ekonomi: EKUILIBRIUM ... keseimbangan baru pada setiap kali perubahan ... nah, biasanya setiap ada perubahan kebijakan bunga the fed maka terjadi reaksi PASAR ... jika bunga naek, tentu aza pasar bereaksi melemah karna terjadi peralihan MODAL ke instrumen bank sentral yang berimbal hasil naek ... namun, kemudian, biasanya terjadi reaksi PEMBALIKAN ARAH (rebound, redirection, antagonistic move) BUNGA TURUN, DUNIA TUMBUH, malah menuju KEMBALInya MODAL (repatriasi negatif, capital inflow, hot money) ke instrumen yang TERNYATA MALAH TETAP BERIMBALHASIL LEBE TINGGI (misalnya, saham, obligasi negara berkembang) ... itu sebabnya PENDULUMISASI EKONOMI GLOBAL slalu TERJADI seh :)

Bisnis.com, JAKARTA – Bursa saham AS ditutup melemah tipis karena investor masih menimbang arah kebijakan moneter Federal Reserve menyusul data ekonomi yang mixed.

Indeks Standard & Poor’s melemah tipis 0,01% atau 0,32 poin ke level 2.186,15 pada penutupan perdagangan, sedangkan indeks Dow Jones Industrial Average melemah 11,98 poin atau 0,06% ke 18.526,14.

"Data ekonomi yang keluar pada minggu terakhir tergolong lemah," kata Walter Todd, kepala investasi Greenwood Capital Associates LLC, kepada Bloomberg.

"Ada sedikit sensasi mengenai kenaikan suku bunga The Fed pada September, tapi sekarang kita kembali ke posisi sebulan yang lalu, mempertanyakan apakah mereka akan meningkatkan suku bunga tahun ini," lanjutnya.

Data yang dirilis Rabu menunjukkan lowongan kerja naik ke rekor tertinggi enam bulan terakhir pada Juli. Secara terpisah, survei Beige Book Fed mengenai kondisi daerah menyatakan ekonomi tumbuh pada kecepatan yang moderat pada bulan Juli dan Agustus karena pasar tenaga kerja yang kuat tidak mampu mendorong kenaikan upah dan harga.

Pada perdagangan Rabu, Bursa saham gagal menguat setelah saham bahan pokok membukukan penurunan terburuk dalam enam pekan terakhir, mengimbangi penguatan sektor teknologi dan energi.

Di antara saham yang membebani sektor bahan pokok, saham Whole Foods anjlok ke level terendah empat bulan terakhir, sementara saham Kroger merosot ke level terendah sejak Maret, sedangkan saham Colgate-Palmolive Co dan Mead Johnson Nutrition Co melemah masing-masing 2% dan 5,5%.

Memperkuat kelompok teknologi, Western Digital Corp melonjak 12% setelah menaikkan outlook kuartal fiskal pertama, sedangkan pesaingnya, Seagate Technology Plc, menguat 5,9% ke level tertinggi dalam lima bulan terakhir.

Kontrak emas yang paling aktif untuk pengiriman Desember naik USid="mce_marker",2 atau 0,09% menjadi menetap di 1.327,1 dolar AS per ounce, seperti dikutip Antara, Selasa (30/8/2016). Logam mulia mendapat dukungan karena pedagang mencerna pernyataan hawkish dari Yellen yang mengatakan akan terbuka kemungkinan kenaikan suku bunga pada bulan depan. Para pedagang tetap percaya Fed baru akan menaikkan suku bunga dari 0,50 ke 0,75 pada  pertemuan Komite Pasar Terbuka Federal (FOMC) Desember. Menurut alat Fedwatch CME Group, probabilitas tersirat saat ini untuk menaikkan suku bunga dari 0,50 ke 0,75 adalah 24% pada pertemuan September 2016, 30% pada pertemuan November 2016, dan 55% pada pertemuan Desember. Para investor sedang menunggu rilis beberapa data utama yang kemungkinan akan menunjukkan pemikiran mereka selama pertemuan FOMC September dalam beberapa minggu mendatang. Laporan klaim pengangguran mingguan akan keluar pada Kamis (1/9/2016) dan laporan ketenagakerjaan besar pada Jumat (2/9/2016), bersama dengan data perdagangan internasional. Logam mulia dicegah dari kenaikan lebih lanjut karena indeks dolar AS naik 0,06% persen menjadi 95,54 pada pukul 17.45 GMT. Indeks adalah ukuran dari dolar terhadap sejumlah mata uang utama. Emas dan dolar biasanya bergerak berlawanan arah, yang berarti jika dolar naik maka emas berjangka akan jatuh, karena emas yang dihargakan dalam dolar AS menjadi lebih mahal bagi investor. http://market.bisnis.com/read/20160830/235/579469/harga-emas-tak-yakin-fed-rate-naik-september-logam-mulia-menguat Sumber : BISNIS.COM By Martin Crutsinger - Associated Press - Monday, August 29, 2016

WASHINGTON (AP) — American consumers boosted spending at a slower pace in July, while their incomes accelerated slightly.

Spending grew 0.3 percent in July following a 0.5 percent increase in June, the Commerce Department reported Monday. The slowdown had been expected given an earlier report that retail sales were flat in July. Incomes grew 0.4 percent in July, up from a 0.3 percent increase in June.

Economists are counting on solid gains in consumer spending, which accounts for 70 percent of economic activity, to power overall growth in the second half of the year.

The deceleration in July is likely to be followed by stronger spending increases in coming months. For July, spending on durable goods such as autos rose by a solid 1.6 percent, but spending for nondurable goods fell.

The overall economy, as measured by the gross domestic product, grew at an anemic annual rate of 1.1 percent in the April-June quarter, marking a full year in which growth has limped along at an annual rate of 1.2 percent. But economists believe many of the headwinds that have been holding back growth are starting to diminish. They expect growth in the current quarter to rebound to above 3 percent, powered by strong consumer spending and solid employment gains.

Federal Reserve Chair Janet Yellen said in a speech Friday that the case for raising interest rates has strengthened in recent months in light of a solid job market and an improved outlook for the economy and inflation. Private economists said the Fed could raise rates as soon as September, but many believe the central bank will end up waiting until December. The Fed hiked rates by a small quarter point last December, marking the first increase after seven years of keeping its key rate at a record low near zero.

INILAHCOM, New York - Gubernur Fed, Janet Yellen mengisyaratkan kenaikan suku bunga Fed bisa tahun ini. Sebab data ekonomi kian membaik dalam beberapa bulan terakhir.

Fed masih memperhatikan beberapa data untuk menaikkan di bulan Desember mendatang. Tetapi juga memungkinkan dilakukan pada bulan September.

Pasar sejak pekan ini telah mengantisipasi pertemuan Jackson Hole untuk pidato yang hawkish. Ada kemungkinan untuk menaikkan lebih cepat dari Desember. Kemungkinan ini direspon positif oleh bursa saham yang mengalami reli, imbal hasil obligasi dan dolar AS melemah, seeperti mengutip cnbc.com.

Tetapi respon menjadi terbalik setelah wakil GUbernur Fed, Stanley Fishcher. Dia masih mempertimbangkan data pekerjaan bulan Agustus yang akan dirilis pekan depan. Dampaknya, bursa saham lebih rendah dan dolar pun melenggang ke area positif. Fischer mendatat data ekonomi telah memperkuat pertumbuhan [pekerjaan yang kuat dalam tiga bulan terakhir. "Pandangan kami, jikta laporan kerja terus menunjukkan pasar tenaga kerja membaik, FOMC mungkin menaikkan suku bunga pada pertemuan September," tulis ekonom GOldman Sachs dalam ulasannya kepada investornya. "Sebagai hasilnya kami telah meningkatkan peluang dalam pertemuan bulan depan menjadi peluangnya 40 persen naik dari 30% sebelumnya."

Fischer menegaskan komentar Yellen ini konsisten kenaikan suku bunga pada bulan September. Bahkan tahun ini mungkin akan ada dua kali kenaikan. Tetapi Fed belum yakin tanpa melihat data ekonomi. Laju inflasi saat ini masih di bawah target Fed sebesar 2 persen dari target. "Kami cukup dekat dengan target di pasar tenaga kerja."

- See more at: http://pasarmodal.inilah.com/read/detail/2320310/suku-bunga-fed-lain-yellen-lain-fischer#sthash.69zWgHLm.dpuf

marketwatch: The pivoted higher in midday trade Friday after remarks from Federal Reserve Chairwoman Janet Yellen were somewhat less hawkish than investors had expected, analysts said.

The greenback fluctuated between gains and losses after Yellen said the case for raising interest rates had strengthened in recent months. Traders, having anticipated a much stronger signal from Yellen, were conflicted about whether her remarks represented a material shift toward a more-hawkish Fed.

Earlier in the week, a bevy of Fed officials, including Dallas Fed President Rob Kaplan, suggested interest rates could soon rise, helping lift the buck.

The ICE U.S. Dollar index DXY, +0.56% a measure of the dollar’s strength against a basket of six rivals, was up 0.3% at 95.0940 in recent trade.

“I don’t think it tells us anything we didn’t already know,” said Adam Cole, head of G-10 currency strategy at RBC Capital Markets.

Expectations for a rate hike by the end of the year have steadily recovered since the U.K. voted to leave the European Union back in June — a decision that briefly sent the probability of a rate hike to zero, as measured by the Fed funds futures market.

On Friday, futures traders were pricing in a more than 50% chance of a hike by the end of the year.

U.S. economic data released early Friday had little impact on the market. The highlight — a revised reading on the pace of U.S. economic growth in the second quarter — left the pace of growth at 1.1%, little-changed from the initial reading.

The dollar USDJPY, +0.96% was changing hands at ¥101.12 in recent trade, compared with ¥100.58 late Thursday in New York. One euro EURUSD, -0.6203% bought $1.1236, compared with $1.1285 late Thursday.

That dollar bulls found little support in Yellen’s remarks suggests that investors are growing impatient with the Fed, said Jameel Ahmad, chief market analyst at FXTM.

“They’re not moving to the words anymore, whereas last year traders were moving to the beat of the statement,” Ahmad said.

Investors are now looking ahead to a report on U.S. jobs growth in August, a widely watched data point expected to be released next Friday.

Bisnis.com, TOKYO – Pergerakan bursa saham Asia dilaporkan menguat pada perdagangan pagi ini, Rabu (24/8/2016), dipimpin oleh pergerakan saham di Tokyo di tengah spekulasi bahwa bank sentral AS Federal Reserve tidak akan terburu-buru menaikkan suku bunganya akibat data ekonomi yang beragam.

Indeks MSCI Asia Pacific naik 0,1% ke 139,34 pada pukul 09.07 pagi waktu Tokyo (07.07 WIB), sementara indeks Topix Jepang menguat 0,7% saat yen diperdagangkan di posisi 100,34 terhadap dolar AS.

Seperti dilansir Bloomberg hari ini, indeks S&P 500 ditutup di posisi mendekati level tertingginya setelah rilis laporan yang menunjukkan lonjakan pada penjualan rumah baru di AS. Namun di sisi lain, perlambatan pada manufaktur memberi pertanyaan akan sinyal hawkish beberapa pejabat The Fed baru-baru ini.

Menurut data Bloomberg, terdapat 29% kemungkinan penaikan suku bunga untuk September.

“Sementara data AS menunjukkan hasil yang beragam, isu dasar bagi The Fed kemungkinan adalah untuk menaikkan suku bunga ketika tidak ada alasan kuat untuk melakukannya,” ujar Kepala strategi pasar CMC Markets Michael McCarthy.

Lebih lanjut menurutnya, The Fed menyadari adanya risiko besar jika kondisi ekonomi memburuk maka hanya akan ada sangat sedikit ruang untuk bergerak.

Sejalan dengan pergerakan bursa Asia, indeks Kospi Korea Selatan naik 0,1%. Sementara, indeks S&P/ASX 200 Australia menguat 0,1% dan indeks S&P/NZX 50 New Zealand turun 0,1%.

Tokyo, Aug 19, 2016 (AFP)

Tokyo stocks climbed in early trade on Friday, tracking a positive lead from Wall Street and as a rally in oil prices lifted sentiment.

US equities ended modestly higher on Thursday, a day after minutes from the Federal Reserve's July meeting suggested policymakers were not yet ready to go ahead with an interest rate hike next month.

Petroleum-linked shares got a boost after crude prices extended their rally Thursday following data showing a decline in US stockpiles, with Brent oil finishing above $50 a barrel for the first time in nearly two months.

In Tokyo, the jump in oil prices also boosted energy-linked shares, with Inpex up more than three percent in early deals and refiner JX Holdings gaining more than two percent.

About 20 minutes after the opening bell, the benchmark Nikkei 225 index climbed 0.47 percent, or 77.40 points, to 16,563.41, rebounding from the previous day's 1.6-percent drop.

The broader Topix index of all first-section shares rose 0.41 percent, or 5.31 points, to 1,296.10.

"Stocks will recover some of the sharp losses it saw yesterday, taking cues from the mild gain in US shares, even though investors are likely to remain wary over the recent strength in the yen," Juichi Wako, a senior strategist with Nomura Holdings, told Bloomberg News.

In forex markets, the Japanese currency eased somewhat against the dollar, with the greenback changing hands at 100.23 yen against 99.94 yen Thursday in New York.

A weaker yen is a plus for Japan's exporters, as it boosts the overseas profitability of exporters.

On Wall Street on Thursday, the Dow closed 0.1 percent higher, while the broad-based S&P 500 and tech-rich Nasdaq both rose 0.2 percent.

dhl/sls

<org idsrc="isin" value="JP3386450005">JX HOLDINGS</org>

<org idsrc="isin" value="JP3294460005">INPEX</org>

New York - Kurs dolar AS melemah terhadap sebagian besar mata uang utama pada Senin (15/8/2016) waktu AS, karena data ekonomi lesu di Amerika Serikat baru-baru ini memperlemah harapan pasar untuk kenaikan suku bunga tahun ini.

Departemen Perdagangan pada Jumat (12/8) mengumumkan bahwa perkiraan awal penjualan ritel dan makanan AS untuk Juli mencapai 457,7 miliar dolar AS, hampir tidak berubah dari bulan sebelumnya dan di bawah perkiraan pasar naik 0,4 persen.

Indeks Harga Produsen untuk permintaan akhir menurun 0,4 persen pada Juli, disesuaikan secara musiman, meleset dari konsensus pasar untuk kenaikan 0,1 persen, Departemen Tenaga Kerja AS mengatakan Jumat lalu.

Para analis mengatakan data suram menimbulkan kekhawatiran pasar tentang kekuatan pertumbuhan ekonomi AS pada kuartal ketiga.

Sementara itu, para investor sedang menunggu risalah pertemuan terakhir Federal Reserve yang dipantau cermat, yang akan dirilis pada Rabu, untuk mendapatkan petunjuk tentang waktu kenaikan suku bunga Fed lebih lanjut.

Indeks dolar, yang mengukur greenback terhadap enam mata uang utama, turun 0,11 persen menjadi 95,618 pada akhir perdagangan.

Pada akhir perdagangan New York, euro naik menjadi 1,1185 dolar dari 1,1171 dolar pada sesi sebelumnya, dan pound Inggris merosot ke 1,2874 dolar dari 1,2911 dolar. Dolar Australia naik ke 0,7682 dolar dari 0,7650 dolar.

Dolar dibeli 101,23 yen Jepang, lebih tinggi dari 101,14 yen di sesi sebelumnya. Dolar jatuh menjadi 0,9723 franc Swiss dari 0,9742 franc Swiss, dan turun tipis menjadi 1,2912 dolar Kanada dari 1,2958 dolar Kanada.

http://pasarmodal.inilah.com/read/detail/2317452/data-ekonomi-lesu-benamkan-dolar-as

Sumber : INILAH.COM

market view: The Federal Reserve raises rates. Those five words should strike fear into any Latin American investor’s heart. After all, there are plenty of painful episodes in living memory when a US rate rise spelt disaster for the region.When Fed Chairman Paul Volker brought in eye-watering rates in 1979 to crush inflation, it was the trigger for Latin America’s ‘lost decade’. Then in 1994, another US rate rise sparked the ‘Tequila Crisis’. So with Latin America’s growth already struggling, you can see why analysts are worried about the impact of this latest rise.

But the pessimists are wrong. One or two of the badly-managed LatAm economies will suffer but for the rest this decision marks the beginning of an upturn.

What the Central Bank Governors told LatAm INVESTOR

Over the past year or so, LatAm INVESTOR has interviewed central bank governors across Latin America. And in every meeting we asked about the looming prospect of US tightening monetary policy. They all recognised it as a powerful factor – one that they couldn’t completely counteract through their own policies – but they were very sanguine about it. In fact, some even welcomed it.

Obviously central bank governors can be keen to talk up their economies – it doesn’t look great if they tell journalists that they’ve lost control and it’s all going to hell in a hand basket. Yet their responses to our questions on tighter policy are very revealing.

Timing is everything

When LatAm INVESTOR spoke to Rodrigo Vergara, Governor of the Central Bank of Chile, he pointed out that it was all about managing expectations.

“With regards to the tightening of US monetary policy I think that a lot of it is already priced by the market. The Fed has been very clear about what we can expect… So if Fed actions more or less follow the expectations that have been laid out then I don’t expect Chile to be in much difficulty. Of course problems could arise if the US tightens much more quickly than expected. But even this could only be a short-term.”

Say what you want about the Fed but they certainly let us know this was coming. Wednesday’s rise was very predictable so investors, policymakers and central bankers have had time to adjust.

It’s happening for the right reasons

Adolfo Meisel , Co-Director of the Central Bank of Colombia, told LatAm INVESTOR that he felt that with all the fear about rising rates, people were forgetting that they were going up for a good reason.

“If the US does have a big change and decide to tighten policy, it will coincide with their economy improving. As they are our main trading partner that would also be a positive for us.”

The US recovery isn’t just a good story for Colombia, all of Latin America should benefit, especially Mexico, Central America and the Caribbean.

Latin America is in a much stronger position now

Back in the 80s and the 90s Latin American countries were loaded up with dollar-denominated debt when US rates rose. That’s why the Fed decision hit them so hard. This time around they don’t just have lower debt levels, they also have a higher proportion of local borrowing, which is easier to service in times like these.

It’s something that Agustin Carstens, Governor of the Central Bank of Mexico, pointed out to LatAm INVESTOR.

Another positive change is that the main LatAm economies have floating exchange rates as opposed to fixed rates that come under pressure when the dollar rises. In past crises Latin American countries burned through billions of dollars of reserves trying to defend unrealistic currency valuations. Now most don’t and that’s something that Chile’s Vergara was keen to stress when he met with LatAm INVESTOR.“Investors have tended to differentiate between those economies with strong fundamentals and those with weaker positions. Mexico has adopted sound and credible macroeconomic policies and strengthened their economic fundamentals during the past years. And this has helped to create an environment of macroeconomic stability that has improved investors’ confidence. All of which, has significantly reduced the vulnerability to negative external shocks.”

“It is important to bear in mind that the policy framework in Chile contemplates a floating exchange rate, which allows for faster resource allocation, which we believe is one of our strengths. The Chilean peso acts as a shock absorber and it has already depreciated significantly in the last year.”

Good management

Of course not everything in Latin America’s garden is rosy. Even the countries with good fundamentals have some issues. But part of its new strength is that these economies are better managed. For example, Julio Velarde, Governor of the Central Reserve Bank of Peru, was at pains to explain to me how the country is slowly managing the dollar debt exposure that some of its companies have.

A generation of policymakers and technocrats that grew up during the crises of the 80s and 90s seems determined to not to repeat the same mistakes.“In our case a currency depreciation, particularly if it is large and sudden, poses considerable risks; namely, households and firms with currency mismatches in their balance sheets may experience solvency problems triggered by a sudden depreciation. In order to mitigate these risks, the BCRP has implemented macro-prudential policies to reduce banks’ reliance on foreign currency funding and curb excessive credit expansion, particularly in exposed segments like car and mortgage loans.”

Far from being the deathknell for Latin America the Fed’s decision highlights how far the region has come. This new found resilience is another great reason to be invested in Latin America.

The sharp rebound in the U.S. job market in June and July has Wall Street buzzing again about a possible interest rate hike by the Federal Reserve at its September meeting. But a rate increase next month is still far from a sure thing, Wall Street economists say.

No question, the muscular July jobs report — 255,000 new jobs were created, a whopping 75,000 more than expected — on top of upwardly revised job gains of 292,000 in June, gives the Fed renewed ammunition to at least make a case for the first bump up in short-term rates this year. Back-to-back months of strong employment reports erase much of the fear sowed by the super-weak May report, when a feeble 24,000 jobs were created.

It's a "reassuring report," Mark Hamrick, senior economic analyst at Bankrate.com, said via email, noting that it dispels fears about the U.S. economy, which has been growing at a subpar 1% clip this year.

Stocks rallied on the news, with the Standard & Poor's 500 stock index climbing above its July 22 record closing high.

The renewed momentum in the employment market confirms the "job market is on solid footing," adds Sung Won Sohn, an economics professor at California State University Channel Islands.

But — and it's a big but — there are still enough blemishes on the U.S. economy's recent track record (namely weaker-than-expected 1.2% economic growth in the second quarter after tepid GDP growth of 1.1% in the first three months of the year) to keep the data-dependent Fed patient and hold rates steady next month, market pros say.

Add in the still unknown fallout from the June 23 vote by Britain to exit the European Union, tepid global growth, a new bear market for U.S.-produced oil and another spike in the value of the U.S. dollar, and its clear the Fed still has things to worry about before pulling the trigger on a rate hike.

The Fed will want to look at more data — including the August jobs report that will be released three weeks before the Fed's Sept. 20-21 meeting — to make sure the economy is strong enough to weather higher borrowing costs.

"The Fed will want to see more confirmation that the U.S. economy seems to be on solid footing," Tom Anderson, chief investment officer at Boston Private Wealth, told USA TODAY. "There are enough uncertainties out there, and this Fed will want to see a lot of supportive data before their next interest rate move."

The Fed last raised rates in December, the first hike in nearly a decade. The Janet Yellen-led U.S. central bank has held off because of foreign economic and market uncertainties, a wait-and-see approach related to Brexit, persistent slow growth in the U.S. and still-low inflation.

But despite talk of a September hike, the Fed will likely play it safe and hold off on a rate increase until its December meeting — and after the presidential election, Anderson says.

Adds Sohn: "If the next payroll report before September is solid, there is a good possibility of a hike at the September meeting. Nevertheless, there are still uncertainties, including political, economic and global. Energy prices are falling again, and the Fed's 2% inflation target is unlikely to be met in the near future. Under the circumstances, there is no rush. The Fed may decide to wait a while longer."

Jesse Hurwitz, an economist at Barclays, says the key things to watch related to the Fed's rate-hike timetable are how strong the August jobs report comes in and Yellen's key policy speech in Jackson Hole, Wyo., on Aug. 26.

For now, the good news for Wall Street and Main Street is jobs are plentiful, the Fed is still likely on hold and stocks are on the rise.

Tokyo, Aug 1, 2016 (AFP)

Emerging market currencies jumped against the dollar on Monday as weak US growth data torpedoed speculation of an interest rate hike this year.

Friday's report showing the world's top economy expanded 1.2 percent in the April-June quarter poured cold water on expectations the US central bank will raise rates before year's end.

Analysts had expected growth closer to 2.6 percent.

"The GDP was a massive miss, so I'm not surprised by the huge dollar selloff that ensued," Thomas Averill, a Sydney-based managing director at Rochford Capital, a currency and rates risk-management company, told Bloomberg News.

"The immediate risk at the moment is for a bit of further weakness in the US dollar on the moderated monetary tightening view."

The greenback took a hammering on Friday in response to the below-par US growth figures and extended its losses Monday.

The oil-reliant Malaysian ringgit jumped 0.8 percent, with extra support coming from a pick-up in crude prices, while the South Korean won also was 0.8 percent higher.

Taiwan's dollar was up 0.6 percent and the Indonesian rupiah rose 0.5 percent, while the Thai baht and Philippine peso also booked solid gains.

However, the greenback rose to 102.61 yen from 102.07 yen in New York, although it is still down sharply from 103.58 yen in Tokyo earlier Friday before the US data release.

The euro ticked up to $1.1180 and 114.47 yen from $1.1177 and 114.09 yen in US trade.

Traders are now awaiting the release of details of a 28 trillion yen fiscal stimulus programme unveiled by Japan's government last week, with Prime Minister Shinzo Abe tipped to make a statement on Tuesday.

TRIBUNNEWS.COM, JAKARTA - Pasca keluarnya Inggris dari Uni Eropa (Britain Exit/Brexit), berdampak kepada revisi target pertumbuhan ekonomi berbagai negara.

Brexit ternyata juga cukup kuat mempengaruhi kebijakan bank sentral Amerika Serikat The Federal (Fed) dalam menentukan suku bunga.

Kepala Departemen Kebijakan Ekonomi dan Moneter Bank Indonesia Juda Agung menilai The Fed sampai akhir tahun 2016, tidak punya keinginan yang kuat menaikkan suku bunga.

Hal ini disebabkan adanya Brexit yang merubah strategi belanja berbagai negara berkembang.

"Fed Rate (suku bunga acuan The Fed), setelah adanya Brexit, diperkirakan ditunda kenaikannya maksimal sekali," ujar Juda di kantor Kemenko Perekonomian, Jakarta, Senin (25/7/2016)

Juda menjelaskan jika The Fed menunda kenaikan suku bunga, otomatis memberikan sentimen positif dari segi moneter.

Karena pasca Brexit, dampaknya begitu kuat terhadap negara-negara di benua Eropa sekarang yang membutuhkan dorongan pertumbuhan ekonomi

"Sehingga memberi sentimen positif bagi sektor keuangan," ungkap Juda.

Juda memaparkan Brexit bisa berpotensi menurunkan pertumbuhan ekonomi global.

Dari prediksi BI kemungkinan ekonomi di dunia global tahun ini hanya tumbuh 3,1 persen, sedangkan tahun depan perkiraan BI turun dari target yakni 3,4 persen ke 3,2 persen.

"Yang perlu dicermati tentu saja respon-respon negara-negara ini terhadap Brexit," kata Juda.

Juda menambahkan jika The Fed menaikkan suku bunga pasca adanya Brexit, akan berdampak kembali kepada perekonomian Amerika Serikat.

"Katakan dampak Brexit terhadap AS cukup signifikan jadi dia juga khawatir kalau kenaikan suku bunga jadi. Karena apresiasi tentu pengaruh ke sektor manufaktur di AS," papar Juda.

The U.S. central bank said the economy had expanded at a moderate rate and job gains were strong in June. It added that household spending also had been "growing strongly," and pointed to an increase in labor utilization.

While Fed policymakers said they continued to closely monitor inflation data and global economic and financial developments, they indicated less worry about possible shocks that could push the U.S. economy off course.

"Near-term risks to the economic outlook have diminished," the Fed's policy-setting committee said in its statement following a two-day meeting in which it left its benchmark overnight interest rate in a range of 0.25 percent to 0.50 percent.

It noted, however, that inflation expectations were on balance little changed in recent months.

The Fed has held steady on rates since December, when it raised them for the first time in nearly a decade and signaled another four rate increases were in the offing for 2016.

That was scaled back to two hikes this year after central bank policymakers issued new projections in which they also lowered their longer-term growth estimates for the U.S. economy. The Fed is most likely to wait until December to raise rates, according to a Reuters poll of economists.

Wednesday's decision had little impact on financial markets with stocks, bonds and currencies all holding close to their levels prior to the Fed's statement.

"It sounded a reasonably upbeat tone, not a big difference from last time, but a reasonably upbeat tone," said Kathy Jones, chief fixed income strategist at Charles Schwab and Co.

ONE DISSENT

Despite a strong rebound in job growth last month and an economy near full employment, most Fed policymakers had urged caution in raising rates until there was concrete progress in moving inflation toward the central bank's 2 percent target.

The Fed's preferred inflation rate currently stands at 1.6 percent and has been below target for more than four years.

A global economic slowdown, financial market volatility and uncertainty over the impact of Britain's June vote to leave the European Union have repeatedly forced the Fed to delay another rate increase.

The U.S. economy, however, has suffered little initial impact from the so-called 'Brexit' vote. A string of better-than-expected economic data recently as well as an easing in financial conditions also have calmed nerves.

There are three more Fed policy meetings left this year - in September, November and December. A rate hike in November is generally seen as unlikely because that meeting would occur a week before the U.S. presidential election.

Fed officials will now turn their attention to this Friday's first initial estimate of second-quarter GDP, which is expected to show a healthy rebound from the previous quarter.

Kansas City Fed President Esther George was the only policymaker to dissent at this week's meeting. She has favored raising rates at three of the last four meetings.

(Reporting by Lindsay Dunsmuir, Howard Schneider and David Chance; Editing by Paul Simao)

JAKARTA kontan. Bursa Jepang melanjutkan pelemahan pada Kamis (7/7), setelah jatuh cukup dalam kemarin. Investor menimbang terbatasnya mendulang untung di pasar saham dengan ekspektasi yen akan terus melambung di hadapan dollar Amerika Serikat.

Indeks Nikkei 225 di Tokyo melemah 44,48 poin atau 0,29% menjadi 15.334, 51 pada pukul 9:21 waktu setempat. Sedangkan indeks Topix jatuh 0,25% menjadi 1.231,13.

BACA JUGA :

Kemarin, bursa di Tokyo terpangkas sampai 1,8%, kejatuhan kedua terbesar sejak pengumuman Inggris keluar dari Uni Eropa Juni lalu. Ketika itu, bursa Tokyo jatuh sampai 7,3%.

Kemarin, bank sentral Amerika Serikat, The Federal Reserve memutuskan untuk menunda kenaikan suku bunga sampai mendapat gambaran lebih jernih mengenai dampak Brexit. Hal ini mendorong yen terus menguat untuk hari ketiga terhadap dollar AS.

"Tanpa kenaikan bunga AS dan keuntungan kebijakan moneter kini terbatas, investor melihat yen akan menguat sampai 95 per dollar AS dan itu akan membatasi keuntungan di pasar saham," kata Mutsushige Akino, Executive Officer di Ichiyoshi Asset Management Co di Tokyo seperti dikutip Bloomberg. Saat ini, yen diperdagangkan di 101,01 per dollar AS.

Perhatian pasar mendatang diperkirakan tertuju pada laporan ketenagakerjaan AS pada Jumat mendatang. Data ini bahkan diperkirakan bisa mempengaruhi The Fed untuk mempertimbangkan pelonggaran moneter di sisa tahun ini.

Pasar AS

Keputusan The Fed berhati-hati melakukan pengetatan moneter lebih lanjut, melegakan pasar AS. Bursa Amerika Serikat untuk perdagangan Rabu (6/7) ditutup dengan penguatan, juga ditopang kenaikan harga minyak.

Dow Jones Industrial Averagare pada perdagangan kemarin menguat 78 poin atau 0,44% menjadi 17.918,62. Indeks Standard and Poor's 500 juga bertambah 11,18 poin atau 0,54% menjadi 2.099,73.

Harga minyak menanjak 1,78% atau 83 sen kemarin menjadi US$ 47,43 per barel. Nanti malam, AS akan mengumumkan data cadangan minyak.

U.S. stocks shook off worries tied to the U.K.’s vote late last month to exit the European Union, dubbed Brexit, and closed higher Wednesday.

A stronger-than-expected report on nonmanufacturing activity helped nudge investors back into equities, while minutes from the Federal Reserve’s June policy meeting showed the majority of policy makers were in favor of keeping rates on hold.

Some analysts attributed gains in the aftermath of Brexit to investors’ strategy of buying stocks when the market dips, which tends to lead to up-and-down trading.

“In a flat market like we had over the past year and a half, benefiting from a pullback is the only alpha investors can get, so I suspect there is a lot of that kind of ‘buy the dip’ mentality that’s driving the market,” said Steve Chiavarone, associate portfolio manager at Federated Global Allocation Fund.

The S&P 500 index SPX, +0.54% rose 11.18 points, or 0.5%, to finish at 2,099.73. The health-care and consumer discretionary sectors led gains, while sectors considered defensive, such as telecoms and utilities, declined. The Dow Jones Industrial AverageDJIA, +0.44% gained 78 points, or 0.4%, to finish at 17,918.62.

Chiavarone said current levels for the main stock-market indexes aren’t justified given uncertainties around the globe.

“The S&P 500 is trading at 18 times future earnings at a time when we are in the middle of an earnings recession,” he said.

The bounce higher was most pronounced in the tech-heavy Nasdaq Composite Index COMP, +0.75% which advanced 36.26 points, or 0.8%, to settle at 4,859.16. The rally in Nasdaq was led by sharp gains in biotechnology shares. The iShares Nasdaq Biotechnology ETF IBB, +2.37% was up 2.4%.

As markets slide, big banks are oversold

Sure, there are many reasons to worry about Goldman, J.P. Morgan, and other big financial institutions, but all that bad news is priced in.

Earlier sentiment was colored by a flight to assets perceived as safe, like gold and Treasurys, as the market wrestles with the long-term fallout from Brexit.

Treasury yields dipped to record lows in early trade but subsequently rebounded as the demand for safe assets waned. Yields and bond prices move in opposite directions.

The yield on the 10-year Treasury TMUBMUSD10Y, -0.44% rebounded from an all-time low of 1.332% to settle at 1.385% on Wednesday.

Economic news: The minutes of the Fed’s June 14-15 policy meeting revealed that dovish policy makers had grown more vocal, pushing a divided committee firmly on the side of taking no action.

“It is difficult to see how the Fed would raise interest rates when everywhere else rates are low or negative,” said Tom Siomades, head of Hartford Funds Investment Consulting Group.

Fed Gov. Daniel Tarullo speaking at a WSJ Pro event in Washington, said markets have only seen the ‘first chapter’ of Brexit effect on U.S. economy. Tarullo backs waiting on interest-rate hike until inflation gets nearer to 2% target, saying the U.S. economy isn't running hot.

The U.S. trade deficit in May widened by 10% to a three-month high of $41.1 billion, thanks to higher oil prices and stronger demand by consumers for imports such as cellphones, sneakers and home furnishings.

The Institute for Supply Management’s service sector index jumped to 56.5% in June, a much stronger reading than expected and a sign the economy may have pushed past the rough patch it hit in May.

JAKARTA - Gubernur Bank of England (BoE) Mark Carney mungkin sedang menghadapi tugas paling pelik di dunia finansial.

Walau BoE jelas telah mengadakan banyak proses penilaian risiko sebelum hasil Brexit yang mengejutkan, penilaian hanyalah teori semata dan dibisa dipastikan bagaimana konsekuensi sebuah peristiwa bersejarah Brexit sebelum benar-benar terjadi.

Namun, VP of Market Research FXTM Jameel Ahmad mengungkapkan, ada satu elemen penting dari peristiwa tak terduga ini yang belum diperhitungkan dalam pasar finansial, yaitu dampaknya terhadap Federal Reserve Amerika Serikat.

"Federal Reserve jelas tidak mungkin melanjutkan rencananya untuk meningkatkan suku bunga AS. Selain itu ada spekulasi di akhir pekan bahwa Fed bahkan mungkin perlu berbalik arah secara drastis dan memotong suku bunga," ujar Jameel, Rabu (29/6/2016).

Dia berpendapat, bahwa ekspektasi peningkatan suku bunga AS jelas harus kembali ditunda belum benar-benar tergambarkan di harga dolar AS saat ini.

"Artinya dolar AS berisiko mengalami depresiasi tajam di masa mendatang," tutur dia.

(rzy)

Washington, June 23, 2016 (AFP)

Sales of new homes in the United States fell in May following a surge in April, but still remained solidly higher than last year in a growing housing market.

Sales of new single-family houses registered an annual rate of 551,000 units, down 6.0 percent from April, the Commerce Department said. Compared with a year ago, sales were up 8.7 percent. April's strong gain was downwardly revised to 586,000 units, the most robust pace since February 2008. Analysts had expected new-home sales would decline in May, but estimated a smaller drop to 560,000 houses. Sales fell in the Northeast, South and West, but rose in the Midwest. With sales sluggish, the median sales price of new houses fell to $290,400, the lowest level in 11 months. Despite the month-over-month volatility, the trend in new-home sales remained firm. In the first five months of the year, sales were up 6.4 percent from the same period in 2015. "With employment rising strongly and mortgages easier to obtain, we think a sustained upward trend in new-home sales is now a reasonable bet," said Ian Shepherdson of Pantheon Macroeconomics. He pointed to a rising trend in mortgage applications that bodes well for increased sales in the coming months. Data published Wednesday for the much larger market of existing, or previously owned, homes in May showed strong demand in the crucial spring home-buying season.

The National Association of Realtors reported that existing-home sales grew 1.8 percent in May to an annual rate of 5.53 million units, the highest pace in over nine years.

MW :

If the Federal Reserve’s “dot plot” reveals anything, it’s that the stewards of the American economy are even more pessimistic now than they were just a few months ago about how fast the U.S. can grow.

Not very long ago, top Fed officials were laying the groundwork for an interest-rate increase in June and talking optimistically about the economy. And now? They’ve put off an increase for the time being, see fewer hikes in the next few years and don’t think growth will speed up fast enough to push rates beyond 3% in the “longer run.”

The downshift is somewhat jarring.

Sure, the pace of hiring in the U.S. slowed sharply in May and April, but job openings remain at a record high, layoffs are near a four-decade low, wages are rising and small businesses are more optimistic than they’ve been in years. Fed Chairwoman Janet Yellen even said she and other central bank members think hiring will rebound.

If that’s the case, the Fed’s downshift in the size and timing of future interest-rate increases can only reflect broader worries about growth at home and abroad. Read: Fed’s Yellen still has doubts.

Yellen mentioned low business investment and productivity — they go hand in hand — in a press conference after the Fed meeting. The Fed’s own forecast sees U.S. growth topping out at 2% in the long run, well below the nation’s historic 3.3% growth rate. Looming in the background is persistently weak global growth.

“Yellen highlighted a large amount of uncertainty for various structural growth factors,” economists at BofA Merrill Lynch said in a note to clients. Read: Fed leaves interest rates unchanged.

That’s why the central bank on Wednesday trimmed its forecast for its benchmark fed funds interest rate, a short-term measure that helps determine how much it costs businesses and consumers to borrow money.

The Fed still expects to raise interest rates twice in 2016, from the current target range of 0.25% to 0.50%. But it only predicts three hikes in both 2017 and 2018, down from four in its March forecast.

The Fed’s indecision should not come as a surprise. The central bank has gone to the edge of a rate hike a number of times in the past few years, only to pull back.

“The FOMC is planning on waiting for conclusive proof of life in the labor market and the risk of global developments to fade before starting a sustained lift off of interest rates,” economists at UBS noted.

Although waiting poses its own dangers, the Fed clearly thinks it’s better to err on the side of passiveness.

It’s not all bad, though. That means the cost of borrowing will remain quite low.

“If you are still looking to refinance your mortgage, or buy a house or car, rates are likely to remain very attractive by historical standards,” said Scott Anderson, chief economist at Bank of the West.

marketwatch: The Federal Reserve is looking nowhere near raising interest rates this week, but by putting off another rate hike Chairwoman Janet Yellen and Co. risk setting the U.S. and the world up for another economic crisis, strategists warn.

Speaking at the Inside ETFs Europe conference in Amsterdam this week, several analysts argued the Fed should have started the tightening cycle years ago instead of letting outside events, such as China jitters, the commodity crash and stock market volatility determine the path of rate hikes.

“The Fed knows it is putting monstrous distortions on the domestic economy, because of the misallocation of resources that’s caused by having money mispriced,” said Kit Juckes, macro strategist at Société Générale.

“I would argue that the Fed having rates that were too low in [2002-2006] caused monstrous misallocations of capital throughout the world, whose effects we felt in [2008-2015] and currently also in 2016 and counting,” he added. “If the cure to the downside of this is to have the same misallocation of capital, the only thing I don’t know is exactly where the problems will show up next. But I can see the Chinese boom followed by a bust, I can see the commodity boom followed by a bust, and I wish we could get back to an even keel.”

The comments come as the Fed kicked off its two-day policy meeting on Tuesday, with investors hoping for guidance on the future of interest rates. The central bank indicated in minutes from its late April meeting it was getting ready to hike rates as soon as June, a view that was later strengthened by a string of hawkish comments from several Fed officials.

However, after a disappointing reading on nonfarm payrolls in May, expectations of a policy change have been dialed back significantly. According to the CME Fed Watch tool, financial markets are only pricing in a 1.9% possibility of a rate increase.

Markets aren’t even pricing in a rise until December, which would leave a full year between rate hikes. But according to strategists, the Fed would only hurt itself if it waits longer to tighten policy.

“The longer they leave rates low, the greater economic and asset-class instability it creates. It’s a bit like having a concrete pillar, and you are pulling that concrete pillar with an elastic band. It doesn’t really do much, but eventually it snaps back and hits you in the face. That’s the risk of having too low monetary policy for too long,” said James Butterfill, head of research and investment strategy at ETF Securities.

He explained that among most dangerous side effects of loose policy is a hit to the banking sector because the low interest rates make it harder for the banks to make a profit.

“That ends up creating a poor lending environment and eventually that squeezes economic growth. That’s the unintended economic consequences,” Butterfill said.

The warnings on ultraloose central bank echo concerns raised at the international FundForum conference in Berlin last week. There, key fund manages warned central banks were setting the global economy up for another “Lehman moment”.

The Fed meeting wraps up on Wednesday with the rate announcement due at 2 p.m. Eastern Time and Yellen’s press conference at 2:30 p.m.

Washington - The Federal Reserve atau bank sentral AS pada Rabu mempertahankan suku bunga utamanya tidak berubah, tetapi mengindikasikan bahwa meskipun pertumbuhan ekonomi lebih lambat masih bisa menaikkan suku bunga dua kali tahun ini.

The Fed memangkas prospek pertumbuhan untuk Amerika Serikat menjadi 2,0 persen untuk tahun ini dan 2017, tetapi juga mengindikasikan melihat inflasi meningkat sedikit tahun ini yang akan mendukung suku bunga federal fund lebih tinggi. Dalam pernyataan kebijakan yang hati-hati pada akhir pertemuan dua hari, Komite Pasar Terbuka Federal (FOMC) mengatakan bahwa kegiatan ekonomi telah tampak meningkat sejak pertemuan terakhir pada April, dan pengeluaran rumah tangga telah menguat, tapi pasar tenaga kerja dan investasi bisnis keduanya melambat. Ini mendekati perkiraannya bahwa inflasi akan naik ke targetnya di 2,0 persen "dalam jangka menengah" tetapi Fed terus mengawasi harga-harga. The Fed juga menegaskan bahwa ia terus mengawasi perkembangan ekonomi dan keuangan global. Tapi pernyataan FOMC tidak menyinggung pemungutan suara di Inggris minggu depan tentang apakah negara itu keluar atau tetap di Uni Eropa, yang telah mendorong volatilitas di pasar di tengah kekhawatiran bahwa hal itu bisa mengakibatkan kerusakan ekonomi riil. Secara umum, meskipun, FOMC menyatakan keyakinannya tentang kecenderungan kenaikan dalam ekonomi AS, dan anggota-anggota menunjukkan dalam rata-rata perkiraan mereka bahwa mereka memperkirakan peningkatan suku bunga federal fund dari saat ini 0,25-0,50 persen menjadi hampir 1,0 persen pada akhir tahun, yang berarti peningkatan dua perempat poin. http://pasarmodal.inilah.com/read/detail/2303484/the-fed-pertahankan-suku-bunga-acuan

Sumber : INILAH.COM

JAKARTA. Keputusan bank sentral Amerika Serikat akan diketahui pada Kamis dini hari WIB (16/6/2016).

Kebijakan bank sentral makin menjadi fokus pasar, dan imbal hasil global terus anjlok. “Saat ini peluang pemangkasan FFR (Fed funds rate) target di Juin 2016 turun ke 0%, tetapi volatilitas diperkirakan masih tinggi minggu ini,†kata Ekonom Samuel Sekuritas Indonesia Rangga Cipta dalam risetnya. Sementara itu, ujarnya, bank sentral Jepang uga akan mengadakan pertemuan, tetapi diprediksi belum akan ada perubahan kebijakan BoJ. Ditambah dengan bank sentral Eropa (ECB) yang mulai membeli obligasi korporasi serta ancaman Brexit. “Imbal hasil US Treasury dan Bund diperkirakan terus turun. Inflasi AS ditunggu Kamis malam, diperkirakan tetap rendah. Dolar diperkirakan tetap lemah,†kata Rangga. http://finansial.bisnis.com/read/20160615/9/557806/fed-boj-ecb-siap-gelontorkan-putusan-ekonom-prediksi-volatilitas-pasar-masih-tinggi-pekan-ini Sumber : BISNIS.COM

cmc: Trading this week is off to a mixed start as traders assess the implications of Friday’s weak nonfarm payrolls, a number of Brexit polls showing the Leave side starting to pull away, and prepare for today’s comments from Fed Chair Yellen.

European trading this morning finds the FTSE up 0.9% and outperforming its continental peers where the Dax is up 0.1% and the CAC down 0.1%. US index futures are flat after Friday’s roller coaster ride which saw US stocks claw back most of their early losses. Commodity trading finds crude oil up nearly 1.0% today with Brent sitting on $50.00 once again and WTI trading above $49.00. Commodity gains are broad based with copper rising 0.5% plus corn and wheat gaining 1.5%.

Friday’s nonfarm payrolls report which showed jobs only increasing by 38K sparked an initially big knee-jerk reaction from traders who sent USD and stocks lower and gold higher on speculation that this could keep the Fed from raising interest rates in June or July as the central bank had previously been hinting.

Friday afternoon and into today, however, the initial flight to defensive havens has been fading. US stocks have regained all their early losses and remain supported. USD has stabilized at a lower level and has started to rebound today while JPY and gold are starting to drop back. The one defensive haven still attracting capital today is CHF which may continue attracting interest from some traders concerned about the potential for volatility in both the UK and continental Europe around this month’s Brexit vote and Spanish election.

There a been a lot of speculation from FOMC members in recent weeks about the potential for a US interest rate increase in June or July. Today, Fed Chair Yellen gets the last word before the blackout starts heading into next week’s FOMC meeting. While she appears likely to take a neutral stance again, traders will be looking to see if she shifts to dovish from neutral in response to the payrolls.

There are three ways the shockingly low nonfarm payrolls can be interpreted:

As a sign that the US economy is slowing and the Fed should wait for more data before raising interest rates, as was suggested by Fed governor Brainard, a known dove in her speech on Friday.

Considering that there was no warning about a low payroll figure from jobless claims through the month from jobless claims or ADP payrolls, and with the unemployment rate falling to 4.7% from 4.9%, the payroll data could be an outlier with the potential to be revised back upward. Over the weekend, Cleveland Fed President Mester indicated one data point doesn’t change her thinking on gradual rate increases.

A slowing in job growth could also be a sign that the US is nearing full employment. Boston Fed President indicated the 4.7% level has reached his estimate of full employment. He also suggested, however, that while he supports rate hikes over time, it remains to be seen if the May payrolls are an anomaly or the start of labour market slowing.

Where Chair Yellen lands on this divide could have a significant impact on trading in USD and stocks through the week as the big June meeting approaches. It also will be interesting to see if she makes any comments on whether the Brexit vote may influence their decision.

In early May, FOMC several speakers had suggested that they could hold off raising interest rates in June as their meeting is being held just a few day ahead of the UK Brexit referendum. After it was pointed out to them that letting events in Mother England influence their decision making could be seen as giving up US independence, Fed members changed their tune for a couple of weeks and downplayed the influence of Brexit on their thinking. With Friday’s nonfarm payrolls weakness giving the Fed another a domestic to hold off in June and wait to see the next payrolls report, Fed Governor Brainard raised Brexit risks in her speech although regional Presidents Mester and Rosengren appear to have stayed silent on the matter.

Today’s trading in UK markets in reaction to a series of polls showing the Leave side pulling out in front and gaining momentum indicates that the street appears to have already priced in the potential for a Brexit at current levels. GBP continues to come under pressure following polls favouring Leave, but each drop is getting smaller and shorter before support comes in. Meanwhile, the FTSE outperforming continental indices today on all the news favouring Leave momentum suggests that some traders could be thinking that the prospects for the UK should Leave win may be brighter than the prospects for an EU without the UK. It’s also possible the street could be seeing as getting the vote over with and moving on regardless of the result as a potential positive. Either way, it’s becoming clear that fear of a Brexit in the markets continues to fade away.

Canadian gold stocks staged major rallies on Friday outpacing to the gold price to the upside and could be vulnerable today with gold levelling off. Base metal miners could benefit from the rising copper price while energy producers could attract support with crude hovering near $50.

Last week's May jobs report, which showed the weakest hiring in six years, gave Janet Yellen all the cover she needed to kick the can down the road on interest rates and put off any hikes until July or September.

The markets reacted well, as you'd expect, but Yellen left the door open, saying the Fed was "on track" to raise rates "in the coming months." And with that statement, Yellen has consigned investors to yet another cycle of uncertainty and hand-wringing where the markets have to guess what the Fed will do in July or September.

Here's the thing – the vast majority of investors don't understand that rising rates can be terrific for you and your money if you know what to look for and how to identify the best stocks to buy ahead of time, before the markets price a move in.

If you're one of 'em, don't beat yourself up too badly. It's a common misconception.

The next "rate riot" can be a fabulous opportunity, just as it was 16 months ago when I brought three recommendations to your attention under very similar market conditions and circumstances. Anybody who jumped on board has had the opportunity to capture returns of 41.98% versus only 0.86% from the Dow Jones Industrials over the same time frame.

One of the three stocks remains an especially compelling choice today.

Don't miss your chance just because the U.S. Federal Reserve might hike rates.

Why Rate Hike Paranoia Defies History

Millions of investors mistakenly believe that rate hikes spell the death of equities.

The only problem is that's simply not true.

Don't get me wrong. A rate hike is not pretty.

There have been six rate hikes since 1983, and the markets were up an average of 14% over the 250 days immediately preceding the first rate hike, according to Nuveen Asset Management's Robert Doll and Scott Tonneson.

My numbers show that the markets dropped by about 10% "peak to trough" – meaning from top to bottom – when the rate hikes hit. But here's what most people are missing…

…in five of six cases, the markets were up an average of 14.4% only 500 days later.

So much for conventional wisdom.

The other thing to think about is that investors are making a huge stink over what could be less than a quarter-point increase. Even if the Fed were to hike rates four quarters in a row, we'd still be talking about a fed funds rate that's only 1% to 1.25%. That's still extremely low in the scheme of things.

What's interesting about all this is that CEOs have been preparing for rising rates for a long time. That's why you're seeing billions spent on buybacks, mergers and acquisitions, and capital expenditures.

Unlike investors who fear the repercussions of rising rates, CEOs are taking steps to increase value when they eventually come to pass. When you hear me talk about why I'd bet on CEOs over politicians and individual sentiment, this is what I'm alluding to. They're making bets to ensure survival and profitability in anticipation of a time when the markets will make that seem like an impossibility.

My point is that low rates are not the limiter everybody thinks. Instead, they're a form of capital discipline that ultimately leads to far more stable performance over time and, most importantly, the best upside profit potential.

Speaking of which…

Keith Fitz-Gerald has been the Chief Investment Strategist for theMoney Morning team since 2007

Liputan6.com, Jakarta - Bank Dunia memutuskan memangkas perkiraan pertumbuhan ekonomi dunia menjadi 2,4 persen pada 2016 dari sebelumnya 2,9 persen. Menteri Koordinator Bidang Perekonomian Darmin Nasution menilai keputusan itu hal yang wajar.

Darmin mengungkapkan perlambatan ekonomi dunia itu ditandai dengan data-data dari negara maju yang tidak seperti yang diharapkan. Di Amerika Serikat (AS), data jumlah penganggurannya tidak terlalu bagus.

"Kita mau tidak mau ada terkena dampaknya, tapi justru apa yang kita lakukan sebenarnya adalah mencari celah, mencari kans di dalam situasi seperti itu," kata Darmin di Istana Kepresidenan, Jakarta, Rabu (8/6/2016).

Darmin menuturkan modal utama sudah didapat Indonesia dari tahun lalu dengan pertumbuhan ekonomi Indonesia yang membaik setiap kuartalnya. Hingga kuartal I,pertumbuhan ekonomi Indonesia mencapai 4,9 persen. Pertumbuhan ekonomi Indonesia pun diperkirakan lebih baik pada 2016.

Darmin mengakui, peningkatan investasi di sektor industri dinilai tidak mudah. Di tengah tingkat konsumsi dunia yang melemah, para investor lebih memilih untuk wait and see. Berbeda dengan investasi di sektor infrastruktur. "Beda dengan investasi pembangkit listrik, jelas dijualnya di sini, atau jalan tol, jelas pemakainya di sini. Dan itu jangka panjang," ujar Darmin. Fokus pembangunan di sektor infrastruktur itu Darmin menuturkan sebagai salah satu modal Indonesia secara jangka panjang dalam melawan arus pelemahan ekonomi dunia. "Jadi, Indonesia itu sudah menyiapkan langkah-langkah yang bagaimana untuk menjawab bagaimana kita agar tidak terseret. Tidak berarti tidak terpengaruh, pasti ada pengaruhnya," ujar mantan Gubernur Bank Indonesia itu. Pemerintah sendiri menargetkan pertumbuhan ekonomi Indonesia sebesar 5,1 persen pada 2016. Angka itu lebih rendah dbandingkan perkiraan sebelumnya yang mencapai 5,3 persen. (Yas/Ahm) Metrotvnews.com, Washington: Ketua Federal Reserve (The Fed) AS Janet Yellen mengatakan bahwa kenaikan suku bunga tetap sesuai dilakukan secara bertahap. Kenaikan ini memberikan pandangan optimistis secara hati-hati tentang prospek ekonomi AS, namun menghindari memberikan perkiraan waktu langkah bank sentral selanjutnya. "Kekuatan ekonomi yang positif telah melebihi negatif, dan meskipun perekonomian terus menghadapi tantangan, saya terus berharap kemajuan lebih lanjut menuju target lapangan kerja dan inflasi kami," kata Yellen dalam pidatonya di Dewan Urusan Dunia Philadelphia, Senin, seperti dikutip dari Xinhua, sebagaimana dilansir Antara, Selasa (7/6/2016). Dalam sambutannya, ia menghindari memberikan petunjuk tentang batas waktu untuk kenaikan suku bunga lebih lanjut, tetapi mengatakan bahwa dia berharap suku bunga federal funds mungkin perlu meningkat secara bertahap dari waktu ke waktu untuk memastikan stabilitas harga dan kesempatan kerja maksimum yang berkelanjutan dalam jangka panjang. Sikap itu berbeda dengan komentarnya yang dibuat pada 27 Mei, ketika ia memperkirakan kenaikan suku bunga di bulan-bulan mendatang mungkin sesuai. Beberapa analis berpendapat bahwa alasan untuk pernyataan hati-hatinya saat ini mungkin ditemukan dalam data ketenagakerjaan yang mengecewakan

baru-baru ini.

Total penggajian (payroll) tenaga kerja nonpertanian hanya meningkat 38.000 pada Mei, kinerja terlemah sejak September 2010. Namun, Yellen mengatakan dalam pidatonya bahwa seseorang tidak harus melampirkan terlalu banyak kepentingan terhadap laporan bulanan tunggal, dan indikator-indikator tepat waktu lainnya dari pasar tenaga kerja telah lebih positif. Dalam sambutannya, dia menunjuk empat bidang ketidakpastian yang dihadapi ekonomi AS, termasuk investasi bisnis yang lemah, risiko-risiko luar negeri, pertumbuhan produktivitas yang rendah di AS, dan inflasi yang rendah. Fed AS telah mempertahankan suku bunga acuan jangka pendek tidak berubah setelah menaikkannya pada Desember lalu. Setelah rilis data ketenagakerjaan AS untuk Mei pada pekan lalu, pasar sekarang memperkirakan bahwa kenaikan suku bunga pada Juni tidak mungkin. http://ekonomi.metrotvnews.com/globals/3NOYqzyk-ketua-fed-sebut-kenaikan-suku-bunga-dilakukan-bertahap

Sumber : METROTVNEWS.COM

New York, June 3, 2016 (AFP)

The dollar sank against most major currencies Friday after a shockingly weak US jobs report that essentially ruled out a Federal Reserve interest rate increase later this month.

The Labor Department report, showing the economy added a mere 38,000 jobs in May, the smallest number in nearly six years, caught investors by surprise. Analysts had expected 155,000, and the numbers for the two prior months were revised lower. The dismal numbers were expected to give the Federal Reserve reason to hold rates steady at the June 14-15 policy meeting, and possibly in the coming months. The dollar lost 2.0 percent to $1.1364 per euro, and fell 2.1 percent to 106.63 yen. Recent remarks by Fed officials, including Chair Janet Yellen, had highlighted the prospect of a rate hike this month or the next. "The softness of today's report has caused the market to downgrade its expectations for a summer rate hike, and the question now is how that affects Janet Yellen's thinking," said Kathy Lien of BK Asset Management. "The weakness of Friday's report will have investors eyeing every positive comment from Yellen with skepticism." On Monday, Yellen is scheduled to give a speech on the economic outlook and monetary policy in Philadelphia, Pennsylvania. The pound, which slid earlier in the week on uncertainty over Britain's June 23 referendum on whether to leave the European Union, clawed back some ground against the dollar.

<pre> 2100 GMT Friday Thursday

EUR/USD 1.1364 1.1154

EUR/JPY 121.17 121.44

EUR/CHF 1.1092 1.1046

EUR/GBP 0.7828 0.7733

USD/JPY 106.63 108.88

USD/CHF 0.9761 0.9903

GBP/USD 1.4517 1.4424

</pre>

Bisnis.com, JAKARTA - Indeks dolar Amerika Serikat melanjutkan pelemahannya pada awal perdagangan pagi ini, Kamis (2/6/2016) setelah ditutup dengan pelemahan pada akhir perdagangan kemarin.

Indeks yang mengukur pergerakan kurs dolar AS terhadap sejumlah mata uang utama tersebut bergerak turun meski tipis sebesar 0,03% atau 0,029 poin ke level 95,426 pada pukul 06.46 WIB, setelah dibuka di zona merah dengan pelemahan tipis sebesar 0,01% ke level 95,443.

Pada perdagangan Rabu (1/6/2016), indeks dolar AS ditutup dengan pelemahan sebesar 0,45% atau 0,436 poin ke level 95,455, melanjutkan pelemahan sebelumnya.

Meski data manufaktur AS membaik, pasar masih khawatir bahwa gambaran perekonomian AS pada waktu mendatang akan membengkokkan prospek penaikan tingkat suku bunga oleh The Fed secepatnya pada bulan ini.

Data ekonomi AS terbaru, termasuk indeks kepercayaan konsumen yang dirilis pada hari Selasa, dianggap tidak cukup kuat bagi bank sentral tersebut untuk memastikan kebijakan moneter lanjutan.

Kinerja mata uang AS juga mengalami pelemahan terhadap yen pada perdagangan kemarin setelah Perdana Menteri Jepang Shinzo Abe menyatakan di Tokyo tentang penundaan penaikan pajak penjualan negara tersebut.

“Pergerakan dolar mengalami sedikit tekanan sejak rilis data (ekonomi) yang menurun,” kata Omer Esiner, kepala analis pasar Commonwealth Foreign Exchange Inc. “Hal itu memunculkan pertanyaan tentang apakah the Fed akan dapat menaikkan suku bunga.”

Posisi indeks dolar AS

Sumber: Bloomberg Dollar Index

INILAHCOM, New York - Gubernur The Federal Reserve AS. Janet Yellen menegaskan kenaikan suku bunga acuan akan lebih cocok untuk beberapa bulan mendatang jika ada perbaikan dalam data perekonomian.

"Ini sesuai dengan yang saya katakan sebelumnya. Fed akan secara bertahap dan hati-hati dalam menaikkan suku bunga kami dari waktu ke waktu. Mungkin untuk beberapa bulan mendatang, langkah tersebut akan sesuai," katanya saat mengikuti sesi wawancara di Harvard Radcliffe Institute for Advanded Study, seperti mengutip cnbc.com.

Pernyataan tersebut menggugurkan pernyataan rekannya di komitie kebijakan The Fed bahwa target kenaikan suku bunga bisa lebih awal dari jadwal sebelumnya. Bahkan Yellen menyatakan tahun ini akan lebih berhati-hati. Alasannya tingkat inflasi masih di bawah target Fed yaitu 2 persen dan masih banyak risiko secara global.

The Fed mencermati perkembangan harga minyak dunia dan kurs dolar AS. Dua indikator ini yang akan membantu Fed mengarahkan tingkat inflasi sesuai target Fed bila dikelola dengan baik. Yellen juga menilai pertumbuhan ekonomi kuartal pertama bergerak lamban. "Perekonomian terus membaik," kata Yellen.

Komite Kebijakan The Fed akan melakukan pertemuan dua hari pada 14-15 Juni mendatang. Dalam risalah yang beredar pekan kemarin, rapat The Federal Open Market Committee bulan April lalu mengisyaratkan mendukung kenaikan suku bunga pada bulan Juni jika data ekonomi membaik sesuai harapan. Isyarat itu muncul dari beberapa pejabat komite tersebut.

- See more at: http://pasarmodal.inilah.com/read/detail/2298837/inilah-fatwa-yellen-bagi-umat-pasar-modal#sthash.m7IUoliU.dpuf

bloomberg: Federal Reserve Chair Janet Yellen said the ongoing improvement in the U.S. economy would warrant another interest rate increase “in the coming months,” stopping short of giving an explicit hint that the central bank would act in June.

“It’s appropriate -- and I’ve said this in the past -- for the Fed to gradually and cautiously increase our overnight interest rate over time,” Yellen said Friday during remarks at Harvard University in Cambridge, Massachusetts. “Probably in the coming months such a move would be appropriate.”

Yellen will host her colleagues on the Federal Open Market Committee in Washington June 14-15, when they will contemplate a second interest-rate increase following seven years of near-zero borrowing costs that ended when they hiked in December. A series of speeches by Fed officials and the release of the minutes to their April policy meeting have heightened investor expectations for another tightening move either next month or in July.

“The economy is continuing to improve,” she said in a discussion with Harvard economics professor Gregory Mankiw. She added that she expects “inflation will move up over the next couple of years to our 2 percent objective,” provided headwinds holding down price pressures, including energy prices and a stronger dollar, stabilize alongside an improving labor market.

Several regional Fed presidents, ranging from Boston Fed President Eric Rosengren to San Francisco’s John Williams, have in recent weeks urged financial market participants to take more seriously the chances of a rate hike in the next two months, pointing to continued signs of steady if unspectacular growth in the U.S. economy and the waning of risks posed by global economic and financial conditions.

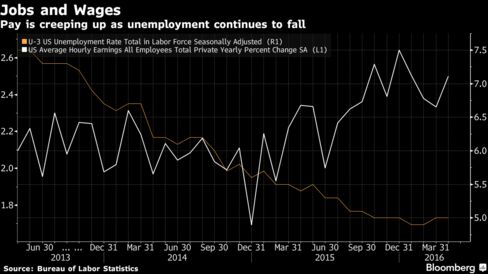

Left scale - hourly earnings; right scale - unemployment

“It sounds like the committee is close to a rate hike, assuming the data hold up, but that no decisions have been made about the precise timing,” Laura Rosner, a senior U.S. economist at BNP Paribas in New York, said in an e-mail. “It will be a collective decision.”

The U.S. labor market has continued to expand even as the jobless rate has declined to 5 percent, which many economists consider to be close to or at full employment. Inflation and wages have also shown signs of edging up, a trend the Fed has longed for but is anxious to keep under control. The May employment report will be released on June 3, three days before Yellen is scheduled to speak publicly again, this time in Philadelphia.

More than incoming economic data, market sentiment over the June meeting has been shifted by FOMC member comments and by the April meeting minutes. Those records, released May 18, showed a majority on the committee favored a June rate increase if the economy continued to improve.

Odds of a June rate hike implied by pricing in federal funds futures contracts were 32 percent following her remarks compared to 28 percent earlier on Friday and about 4 percent two weeks ago.

The FOMC accompanied its December rate hike with projections showing officials expected to raise rates four more times in 2016. Amid renewed worries over global growth and a bout of turmoil in financial markets in January and February, the committee has since held rates steady and cut its median projection for the number of 2016 quarter-point rate increases to two.

Yellen, 69, accepted the Radcliffe Medal, an award given annually by Harvard’s Radcliffe Institute for Advanced Studies to “an individual who has had a transformative impact on society,” according to its website. Supreme Court Justice Ruth Bader Ginsburg received the award in 2015.

World leaders meeting in Japan tangled over how to push the global economy toward growth amid an array of risks including geopolitical tensions, a slowdown in China and Britain’s potential exit from the European Union.

The Group of Seven industrial nations -- the U.S., Japan, Germany, the U.K, France, Italy and Canada -- sought a coordinated approach at a summit in central Japan amid discord over the best policy mix of fiscal spending, monetary stimulus or structural reforms.

G-7 nations will use “all policy tools -- monetary, fiscal and structural -- individually and collectively to strengthen global demand and address supply constraints while continuing our efforts to put debt on a sustainable path,” the group said in a statement Friday after the two-day meeting in Ise-Shima.

The show of comity disguised an undercurrent of dissent over how to create jobs and growth, whether through spending and stimulus measures championed by leaders like Japan’s Shinzo Abe and Canada’s Justin Trudeau, or an approach of budget discipline supported by looser labor markets and better competitiveness, the hallmark of German Chancellor Angela Merkel.

Regional differences played a role, as Asian economies feel the brunt of a Chinese slowdown, while the 19-member euro area struggles with seven years of crisis and a dearth of demand and the U.S. economy revives.

Uneven Dynamic

“It is not entirely surprising that a coordinated response to an unevenly felt dynamic could not be reached at the G-7 negotiating table,” Glenn Maguire, Asia-Pacific chief economist at Australia & New Zealand Banking Group Ltd. in Singapore, said in an e-mail.

“Moreover, the G-7 is obviously aware of the ‘announcement effect’ the official communique has,” he said. “In such a situation, warning of negative risks and sentiment can become self-fulfilling.”

Abe, the host, failed in his bid for the G-7 to warn of the risk of a global economic crisis after making a presentation to other leaders, including U.S. President Barack Obama, which showed an economy potentially veering into a crisis on the scale of the 2008 Lehman Brothers collapse.

Japanese Warning

Japan had pressed G-7 leaders to note "the risk of the global economy exceeding the normal economic cycle and falling into a crisis, if we did not take appropriate policy responses in a timely manner." That phrase was scrapped.

“We are not pessimistic about the global economy, but if we are not clearly aware of the risks, we will not be able to take the appropriate measures,” Abe told reporters at a press conference in which he repeatedly referred to Lehman. “We as G-7 leaders held a thorough debate on the world economy and agreed that we are facing a great risk."

Abe has frequently said he would proceed with a planned increase in Japan’s sales tax in April 2017 unless there is an event on the scale of Lehman or a major earthquake. He is expected to announce next week he is deferring the tax rise, Japanese media reported.

Non-member China loomed over the G-7 talks. A slowdown in the world’s most populous nation, alongside a global steel glut, has spurred concerns among developed economies that turmoil there could send ructions across the globe.

China, Brexit

“We want a good and thriving pace of economic growth for China,” Merkel said earlier Friday. “China also has great structural challenges, for which we wish that China can tackle them, because that’s in all of our interest.”

The leaders added in an 11th-hour warning on the U.K.’s referendum to leave the European Union, saying a so-called Brexit would "reverse the trend towards greater global trade and investment and the jobs they create, and is a further serious risk to growth." The warning wasn’t included in a draft of the communique as of Thursday evening.

Further threats to the world economy include escalating geopolitical conflicts, terrorism and refugee flows, the communique said.

Leaders reaffirmed their commitment to market-determined exchange rates. They warned that "excess volatility and disorderly movements in exchange rates can have adverse implications for economic and financial stability."

TPP Ratification

Trade is a key driver of growth, the document said. It lauds the 12-nation Trans-Pacific Partnership trade pact as "an important step forward" and called on each country to "complete its domestic process," while stopping short of a call to quickly ratify the agreement.

Final approval of the pact has faced delays in countries such as the U.S. and Japan, while Canada has not committed to ratification.

Leaders said they’ll work toward an agreement in principle on the U.S.-EU Transatlantic Trade and Investment Partnership as early as this year, while encouraging the EU and Canada to bring their trade pact into force as quickly as possible.

Banks and technology shares drove the S&P 500 Index to its biggest advance in two months, while the Stoxx Europe 600 Index jumped the most since mid-April. The dollar climbed to its strongest level since March against the euro, denting demand for gold, which capped its longest losing streak since November. The pound strengthened on a poll showing the campaign to keep Britain in the European Union is gaining ground. The Turkish lira climbed after a cabinet reshuffle and a rate cut boosted confidence in the central bank.

After swinging around in the wake of the Fed’s April meeting minutes, markets seem to have grown comfortable with the elevated odds of a U.S. rate increase in the next two months. Traders are now pricing in a better-than-even chance of the central bank boosting borrowing costs at its July meeting, with Fed officials lining up to indicate their willingness to support such a move, should the current strength in the economy be sustained. Data Tuesday showed purchases of new homes surged in April to the highest level since the start of 2008. Investors will scrutinize comments from Fed Chair Janet Yellen later this week, as well as a key government jobs report due next Friday.

“Before there was a sense that higher rates would spell trouble, but the market has had time to digest that,” said Bill Schultz, who oversees $1.2 billion as chief investment officer at McQueen, Ball & Associates Inc. in Bethlehem, Pennsylvania. “People may be coming around on the idea of a rate hike as an indication of economic strength. Maybe there’s a bit more of an optimistic view, and today we’re rallying through the close.”

Investors are also monitoring discussions by euro-area finance ministers on how to conclude Greece’s bailout review, which includes debt-relief measures and contingency plans in case the nation’s budget targets are missed.

Stocks

The S&P 500 jumped 1.4 percent to 2,076.06 as of 4 p.m. in New York. Financial stocks surged 1.6 percent as a group, with JPMorgan Chase & Co. and Citigroup Inc. jumping at least 1.7 percent as Treasury yields climbed to a three-week high.

Toll Brothers Inc. jumped the most in three years following the stronger-than-forecast new-home sales data and as the luxury house builder’s quarterly profit topped estimates. An S&P gauge of homebuilders posted its steepest climb since January 2014.

The Stoxx Europe 600 Index added 2.2 percent Tuesday, its biggest one-day rally since April 13, as insurers and banks led gains.

“People are testing whether the market has found a bottom, and there’s plenty of money sitting on the sidelines,” said Heinz-Gerd Sonnenschein, a strategist at Deutsche Postbank AG in Bonn, Germany. “We’ve had pretty calm, sideways trading this month even with another Fed rate hike looking more likely.”

The MSCI Emerging Markets Index of stocks fell 0.1 percent, while the Borsa Istanbul 100 Index jumped 3.5 percent.

Futures on equity indexes in Asia signaled a rebound, following the MSCI Asia Pacific Index’s 0.9 percent Tuesday. Contracts on Japan’s Nikkei 225 Stock Average jumped 1.6 percent to 16,750 in Osaka amid a 0.7 percent drop in the yen, while futures on benchmarks in Sydney, Seoul and Hong Kong climbed by at least 0.6 percent in most recent trading.

Currencies

The Bloomberg Dollar Spot Index, a gauge of the greenback against 10 major peers, rose 0.3 percent after closing little changed for the previous three sessions. The euro slipped 0.7 percent to $1.1141, while the yen dropped to 109.99.

Sterling jumped 1.8 percent versus the euro and was up 1.1 percent against the dollar, the currency’s first advance versus the greenback in three days. An ORB survey for Britain’s Daily Telegraph newspaper found older voters, previously found to back leaving the EU, are switching sides.

The lira rose 1.6 percent versus the dollar as Mehmet Simsek retained his position as Turkey’s deputy prime minister. Simsek is the last man standing from the team of ruling party officials feted by investors as the driving force behind Turkey’s rapid growth years. The central bank also reduced the country’s overnight-lending rate by 50 basis points, matching the median estimate of analysts.

The yuan was the most resilient of 31 major currencies, gaining 0.02 percent versus the dollar and trimming this year’s loss to 0.9 percent. China’s central bank scrapped a market-based mechanism for managing the currency on Jan. 4, returning to a system whereby the exchange rate is based on what suits authorities the best, the Wall Street Journal reported, citing unidentified people close to the People’s Bank of China.

Commodities